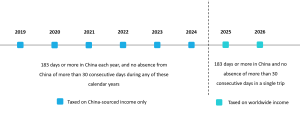

The Individual Income Tax Law (“the IIT Law”) which took effect on 1st January 2019 introduced the “6-year-rule” to determine the tax residency status of non-domiciled individuals in China. According to the IIT Law, non-domiciled individuals who stay in China for more than 183 days each year and have no absence from China for more than 30 consecutive days for 6 years should be taxed on worldwide income. Since the enforcement of IIT Law from 2019, the years of residence in China before 2019 were all reset to 0. And therefore, 2024 is the first 6th year for all non-domiciled individuals who live in China since 2019. Then what you need to do to legitimately cope with this “6-year-rule” so as not to be taxed on the worldwide income?

Let’s take a look at the below flowchart about how the “6-year-rule” works under the IIT Law first.

A non-domiciled individual living in China from 2019 will be taxed on worldwide income from 2025 under the conditions that:

- He/she lives in China for more than 183 days each year and has no absence from China for more than 30 consecutive days from 2019 to 2024; and

- He/she spends 183 days or more in China and has no absence of more than 30 consecutive days in a single trip in 2025.

In light of the above conditions, there are two options to tackle the “6-year-rule”.

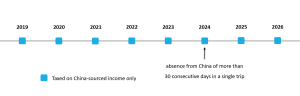

Option 1: Absence from China for more than 30 consecutive days in a single trip in 2024 (see the below flowchart)

By doing so, 2024 is the year that does not count as the 6th year of tax residency in China, and the “6-year-rule” is well counteracted. 2025 will be the first year for the next “6-year-rule”.

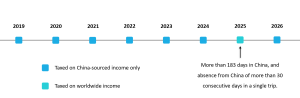

Option 2: Less than 183 days in China and absence from China of more than 30 consecutive days in a single trip in 2025 (see the below flowchart)

Under this circumstance, the non-domiciled individual doesn’t need to be taxed on worldwide income in 2025 even though he/she has been living in China for 6 years because the number of days he/she stays in China is less than 183 in 2025. 2026 will the first year for the next “6-year-rule” if the non-domiciled individual stays in China for more than 183 days at that year.

We understand that it’s difficult for foreigners who have full-time job or business in China to spend less than 183 days for a year. And therefore, what if he/she stays in China for more than 183 days in 2025? Will he / she be taxed on the worldwide income from 2025 on? The answer is No as long as the non-domiciled individual has absence from China for more than 30 consecutive days in a single trip in 2025 (see the below flowchart).

Under this circumstance, the non-domiciled individual is taxed on the worldwide income only for 2025. The number of days of absence from China breaks the “6-year-rule”, and 2026 will be the first year for the next “6-year-rule” assuming he / she spends 183 days or more in China.

As there are only 5 months left for 2024, it’s time for those who have been living in China since 2019 to plan their tax break. If you need our assistance, please feel free to contact us.