SME managers tend to focus on marketing and sales while neglecting inventory management. However, they might never realize that huge tax and financial risks could arise from inaccurate bookkeeping and incorrect inventory write-offs.

Recently, one of our client, lets call them “DELIC Ltd.”, was baffled when they received a notice of mandatory tax adjustment. The general manager, lets give him the alias “Grant” was taken aback by the amount of the adjustment which wiped out most of his companies profits earned in the past few months.

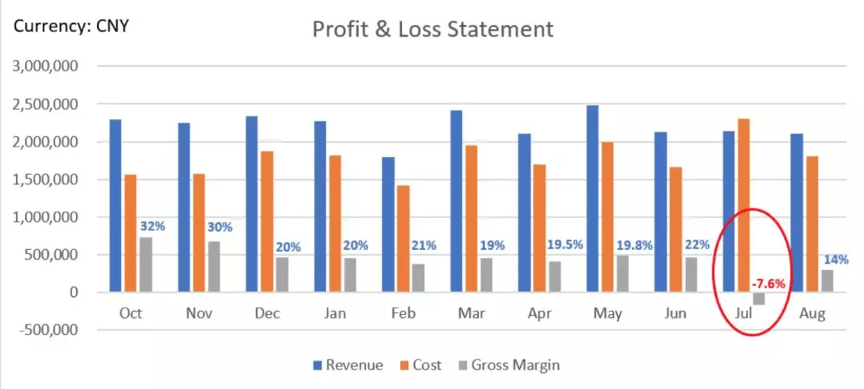

DELIC Ltd. is a trade company that imports food and beverage from South America and sells them in China. Due to its small size, the company did not hire an internal accountant. Its bookkeeping and tax filing are outsourced to a local accounting firm. Sales figures look good. Over the past three quarters, monthly revenue remained at roughly RMB 2 million yuan and gross margin has been around 20% to 30%. Sales team was awarded with substantial bonus as a result.

However, Grant was startled when he saw the P/L statement of July 2016: cost surpassed revenue and as a consequence, a negative margin was reported. What puzzled Grant even more was that in the next year, he received a notice from the tax bureau asking the company to pay up an additional corporate income tax for the year 2016 totaling RMB 126,500 yuan.

Incorrect Inventory Write-Offs

The tax authority stated that the supporting documents failed to justify the RMB 506,000 yuan loss incurred from writing-off expired goods in their inventory. It followed that the loss charged to the P/L statement of July 2016 shall not be deducted from the taxable income.

The document submitted to the tax bureau only included an EXCEL spreadsheet prepared by the warehouse keeper, stating merely the code, item name and the quantity of the obsolete inventory. The arrival and outbound date, actual cost, manufacturing date and expiration date of the inventoried asset, which constitute crucial information and evidence for pre-tax deductions as per China’s corporate income tax laws and regulations, could not be traced. Nor could the outside accountant provide the accounting documents and records related with the obsolete goods, since the accountant worked out the obsolescence loss by deducting the inventory sold from the inventory reduction of the period, which is highly problematic and non-compliant accounting practice.

Inaccurate bookkeeping resulted in missing necessary accounting documents to support the corporate income tax deductions. Alarmed by the outcome brought by the case, Grant approach us to help solve the issue.

Multifold Repercussions For Small Businesses

We examined the case and told Grant that the inappropriate accounting was only the tip of the iceberg. We then proceeded to point out several previously unrealized negative implications associated with DELIC’s inventory accounting practices.

Inefficient inventory management.

It was obvious that the inventory bookkeeping was disconnected with the actual inventory management. Without a detailed recording of the specific information of different batches of the purchased goods, the accountant could not calculate an accurate inventory write-off. Moreover, this also caused huge inventory wastage. When salespeople could not identify the materials that would expire soon, many goods that were not nearing expiration to be sent before those closer to their expiration date. In this case, the ratio of good expiring in the next 60 days was at an alarming 1.25%!

Defective internal control.

Given that the company did not have a system to perform sound inventory management, the accountant was not able to check with the warehouse and therefore the risk of missing goods or theft were high. Realizing such scenarios was only possible during a physical inventory recount making it significantly more difficult or impossible to identify the root cause of missing goods.

Distorted financial statements.

Inventory bookkeeping affected both the balance sheet and P/L statement. The inventory balance, as shown in the balance sheet, did not accurately reflect the actual value of goods in the warehouse. Subsequently, we found that the inventory write-off was not incurred in one month alone, but was the total inventory write-off for the past three quarters.

This violates the accrual accounting principle requiring that cost shall match revenue of the accounting period. As shown in this case, the profit was overstated from Oct. 2015 to June 2016 and was understated in July 2016.

Inappropriate performance assessment.

Grant was misled by the inflated profit figures and came to realize that he had been granting bonuses for performance which was mislead by improper inventory management!

Mounting taxation risks

Because the loss could not be substantiated by evidence, taxable income needed to be adjusted upward by RMB 506,000. With a corporate income tax rate of 25% in China, an amount of RMB 126,500 (506,000*25%) was levied on DELIC. Assuming DELIC had put in place a sound inventory and accounting system, the deduction would have been available. If the inaccurate reporting would have been deemed intentional and therefore fraudulent, DELIC would even be fined by the tax authority anywhere from 1.5 to 6 times the amount due.

Stoqo + Megi: A System Solution

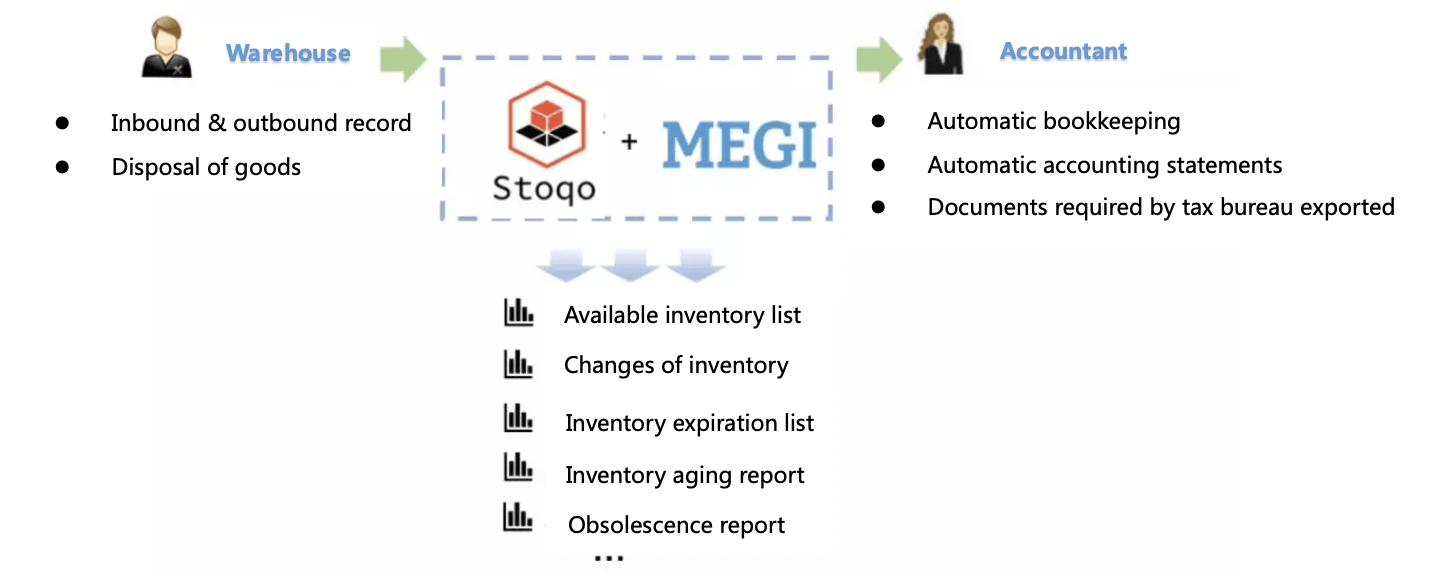

Grant realized that it was his company that would pay the price for the inaccurate inventory accounting and management. Upon his request, the financial consultant offered a solution plan by combining Stoqo and Megi to establish holistic inventory management infrastructure.

Our solution to DELIC Ltd. and Grant was as follows:

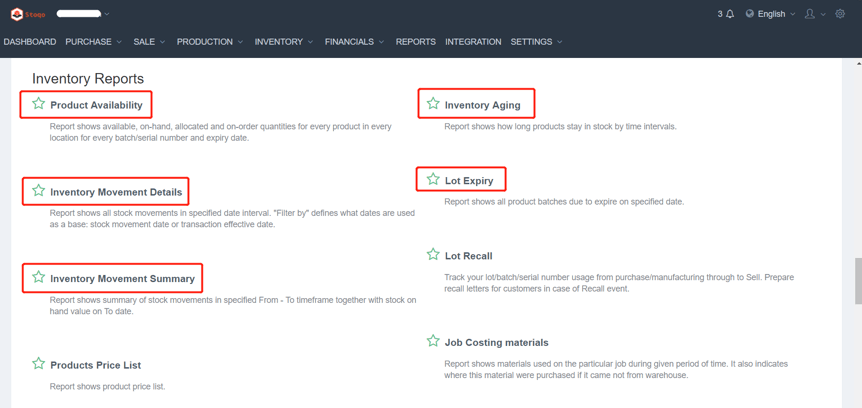

Stoqo is “cloud inventory management software” introduced from Australia to China. It has a user-friendly interface and is tailored made to meet the demands of medium- and small-sized trade companies.![]()

Megi is a cloud accounting software. Through standardized API, it connects with Stoqo to produce financial data using the business information transmitted from Stoqo.

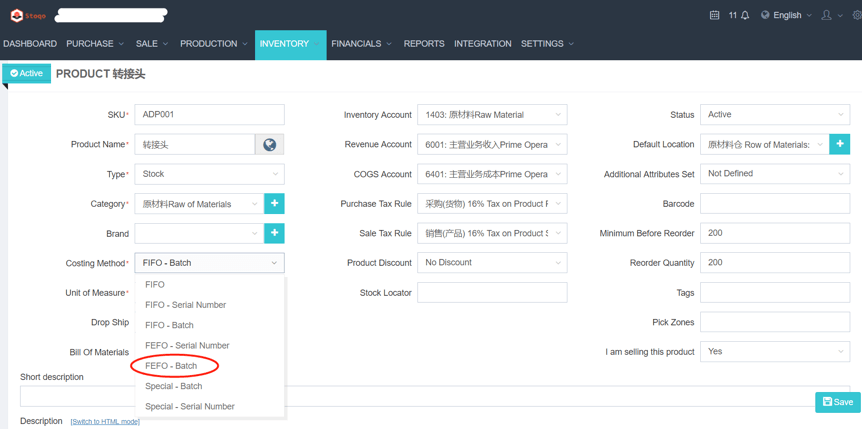

Stoqo offers a variety of cost accounting methods. For example, in this case, given that the inventory has an expiration date, it’s better to adopt “close-to-expiration first out” method.

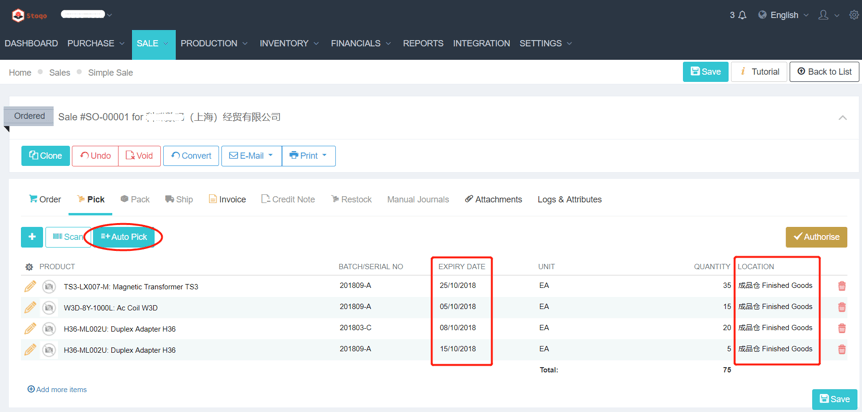

Stoqo adds value for warehouse management as well. Goods closest to sell-by date are automatically identified by the system so that they are shipped out of the warehouse before they are past the date.

At the end of every month, accountants can run the “inventory expiration report” and filter out all the expired goods. The results can be simultaneously updated in Megi and accounting documents and records are generated automatically.

A Sweeping Change For Internal Control

After using the smart software suggested by us, Grant was delighted to find that the solution not only corrected the previous non-compliant practices, but also greatly enhanced internal controls across the entire company. Any stock shortage can be immediately found and timely handled. The cases of goods being missing or stolen and inventory wastage decreased, disposal rate of those goods with shelf life of less than 60 days declined from 1.25% to 0.5% and the disposal rate of goods with shelf life of greater than 60 days drops from 0.633% to 0%.

With accurate inventory bookkeeping and documentation, financial statements will not be distorted, bonuses can be accurately awarded, and last but not least, tax deductions can be fully taken advantage of to realize higher profitability.

The inventory information is also readily available for the management team. Managers do not have to wait until the following month to receive an update on inventory value since real-time data and reports are available through the smart system.

Starting from 2016, China has been launching the biggest tax overhaul in more than two decades, with an increasing number of tax-specific regulations being enacted or revised. Meanwhile, the government is set to establish a tax monitoring platform using state-of-the-art technologies, including big data analytics. Companies, especially small businesses, can draw upon the case of DELIC so as to meet the compliance requirements and deliver better financial results for their shareholders.

References:

- Administrative Measures for Corporate Income Tax Deduction Vouchers, State Administration of Taxation (SAT) Announcement [2018] No. 28.

- Administrative Measures for Deductions of Assets Loss for Corporate Income Tax, SAT Announcement [2009] No. 88.