This article was first published on Axel Standard, a partner of Acheva & Associates. Click here for the original article.

Big data has been around since before it became a buzzword. However, the world now possesses the computing power to efficiently reach complex conclusions about subjects which were previously too large and interconnected to fully comprehend. China has made big data the center of its tax reform and is now using it to identify much of the widespread tax fraud that takes place on a daily basis.

Much of the fraud that takes place in China is businesses manipulating their financial data to minimize their tax liabilities. In the past, it has been too time-consuming for tax authorities to analyze the data and pursue many tax fraud cases on sites. Consequently, very few companies have been subject to a tax audit and tax fraud been pursued. China’s big data tax plan is changing that as analysis of data is being handled with never before seen efficiency.

To better understand the groundwork for “big data driven tax reform” in China, read about the current tax reform agenda including the tax policy changes that have allowed these new efficiency gains.

With the groundwork for data collection and sharing already in place, Chinese tax authorities are able to benchmark your business against predictive data unique to your business as well as industry averages to identify patterns and behaviors closely linked to fraudulent behavior. They do this by;

A business’ revenue can be partially derived from 4 different sources; monthly VAT declaration, output VAT fapiao issued, the monthly P&L report filed with tax bureau and quarterly CIT filings. The figures on these four sources are inherently related to your business’ activities and should be constant with each other.

Many businesses like to postpone recognizing their revenue until a later date thereby delaying VAT and corporate income tax payment, often exceeding the legal limit for accruing their revenue. Through the new e-tax system, the tax authorities know exactly when your client books the fapiao you gave him, giving a clear indication of how much revenue your business should be reported within a given period.

Many businesses like to postpone recognizing their revenue until a later date thereby delaying VAT and corporate income tax payment, often exceeding the legal limit for accruing their revenue. Through the new e-tax system, the tax authorities know exactly when your client books the fapiao you gave him, giving a clear indication of how much revenue your business should be reported within a given period.

Some businesses intentionally report additional expenses on their quarterly CIT declaration to reduce their quarterly tax liability and adjusting it back during the year-end tax adjustment. This becomes obvious every 3rd month (quarter) when Corporate income tax is paid due to a sharp increase in costs that month.

Some businesses intentionally report additional expenses on their quarterly CIT declaration to reduce their quarterly tax liability and adjusting it back during the year-end tax adjustment. This becomes obvious every 3rd month (quarter) when Corporate income tax is paid due to a sharp increase in costs that month.

Many businesses currently report inconsistent and often incorrect figures across these reports in order to minimize individual income tax and social security payments. As of January 2019, social security will be collected by the tax bureau for select organizations and will be applied to all companies very soon. This allows these reports to be reconciled and force businesses to report true and accurate salary figures across all of their financial reports.

Many businesses currently report inconsistent and often incorrect figures across these reports in order to minimize individual income tax and social security payments. As of January 2019, social security will be collected by the tax bureau for select organizations and will be applied to all companies very soon. This allows these reports to be reconciled and force businesses to report true and accurate salary figures across all of their financial reports.

More severe misrepresentation of expenses is the use of fake or irrelevant fapiaos to offset revenue, therefore, reducing CIT payments. In these cases, the cost/sales ratio comparison will be consistently higher than the average and likely require the business to provide evidence to support its financial reporting.

More severe misrepresentation of expenses is the use of fake or irrelevant fapiaos to offset revenue, therefore, reducing CIT payments. In these cases, the cost/sales ratio comparison will be consistently higher than the average and likely require the business to provide evidence to support its financial reporting.

- Reconciling data across multiple financial and tax reports filed with tax authorities.

- Comparisons between the performance of your business across different periods and industry averages.

- Ratio analysis of the financial figures benchmarked vs the relative industry figures.

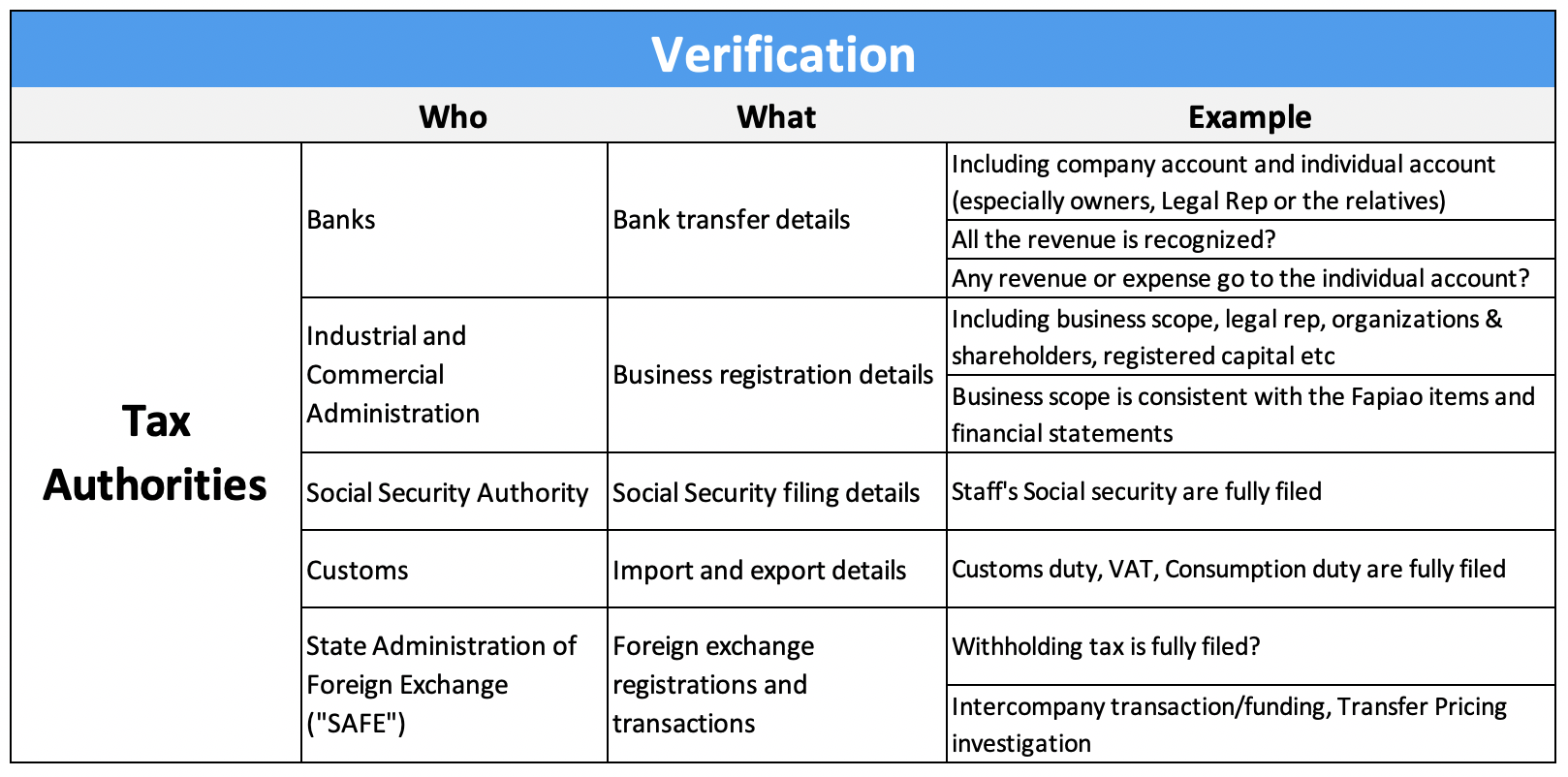

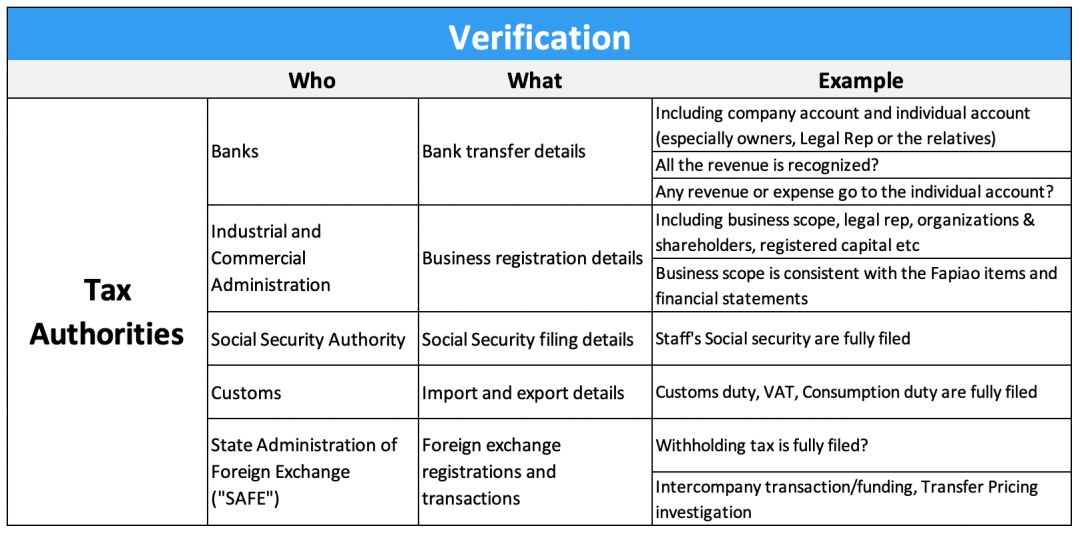

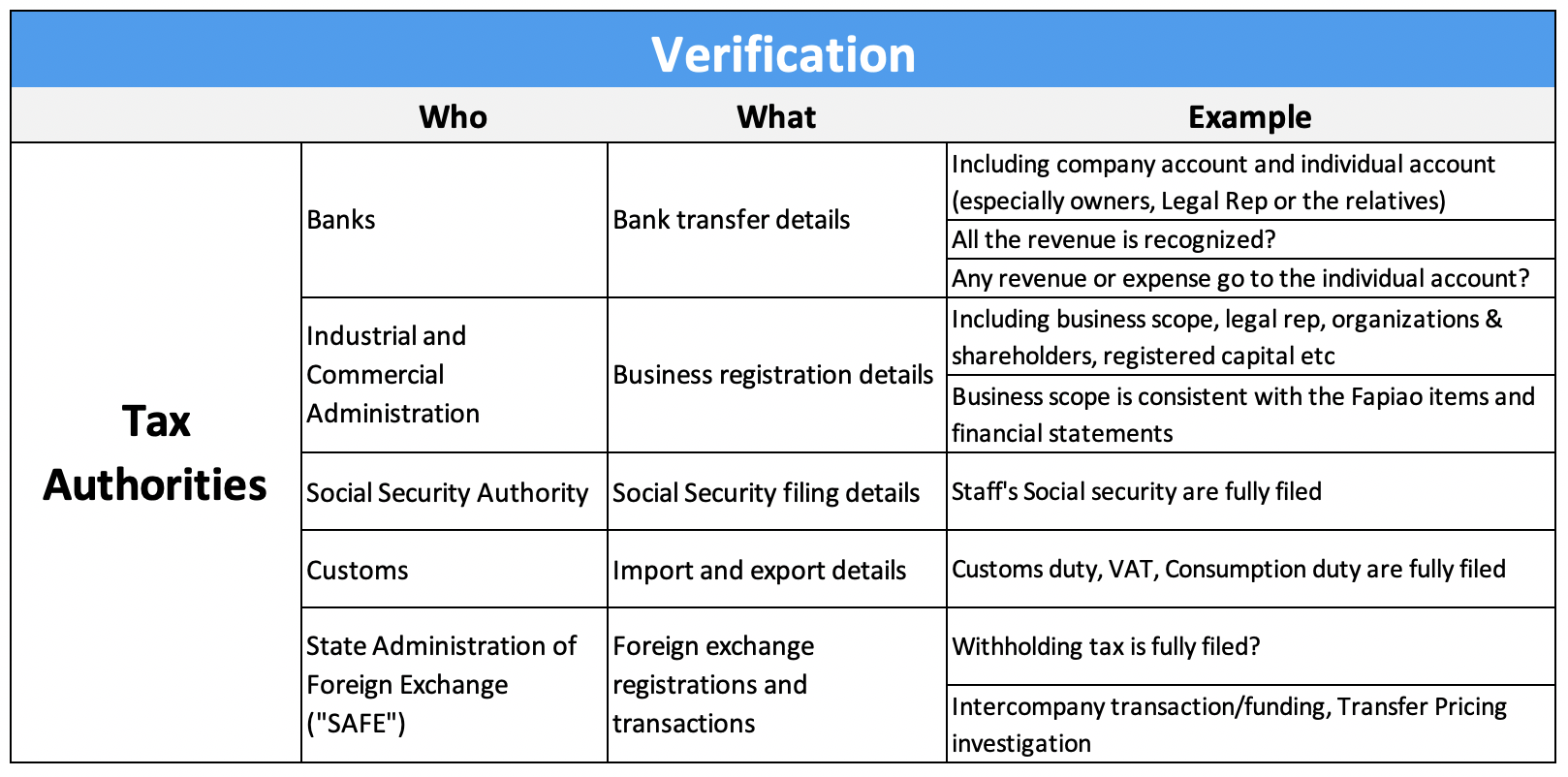

- Verification of both quantitative and qualitative data about your business in tax systems against the information available with other authorities such as the State Administration for Industry and Commerce.

Reconciliation

The various financial and tax reports that you file with tax authority are increasingly being reconciled with one another to ensure businesses are reporting complete and accurate figures and tax liability. Below are some key reconciliations being made in the tax system: Revenue

Revenue

A business’ revenue can be partially derived from 4 different sources; monthly VAT declaration, output VAT fapiao issued, the monthly P&L report filed with tax bureau and quarterly CIT filings. The figures on these four sources are inherently related to your business’ activities and should be constant with each other.

Many businesses like to postpone recognizing their revenue until a later date thereby delaying VAT and corporate income tax payment, often exceeding the legal limit for accruing their revenue. Through the new e-tax system, the tax authorities know exactly when your client books the fapiao you gave him, giving a clear indication of how much revenue your business should be reported within a given period.

Many businesses like to postpone recognizing their revenue until a later date thereby delaying VAT and corporate income tax payment, often exceeding the legal limit for accruing their revenue. Through the new e-tax system, the tax authorities know exactly when your client books the fapiao you gave him, giving a clear indication of how much revenue your business should be reported within a given period.

Profits

A businesses profits can be derived from the business’ monthly P&L statements and their quarterly Corporate Income Tax Filing. Some businesses intentionally report additional expenses on their quarterly CIT declaration to reduce their quarterly tax liability and adjusting it back during the year-end tax adjustment. This becomes obvious every 3rd month (quarter) when Corporate income tax is paid due to a sharp increase in costs that month.

Some businesses intentionally report additional expenses on their quarterly CIT declaration to reduce their quarterly tax liability and adjusting it back during the year-end tax adjustment. This becomes obvious every 3rd month (quarter) when Corporate income tax is paid due to a sharp increase in costs that month.

Salary

Business’ report salary expenses on their quarterly CIT filing, monthly P&L, monthly individual income tax filing, and their employee’s social security filing. Many businesses currently report inconsistent and often incorrect figures across these reports in order to minimize individual income tax and social security payments. As of January 2019, social security will be collected by the tax bureau for select organizations and will be applied to all companies very soon. This allows these reports to be reconciled and force businesses to report true and accurate salary figures across all of their financial reports.

Many businesses currently report inconsistent and often incorrect figures across these reports in order to minimize individual income tax and social security payments. As of January 2019, social security will be collected by the tax bureau for select organizations and will be applied to all companies very soon. This allows these reports to be reconciled and force businesses to report true and accurate salary figures across all of their financial reports.

Fapiao

Contained on input VAT fapiaos and output VAT fapiaos are predefined product and service categories. These categories are reconciled by the tax authorities to ensure input fapiaos are relevant to output fapiaos.Comparison

Businesses who operate within their scope of business and only engage in legal tax planning activities will present financial reports and other business data which are plausible and predictable. Tax authorities will regularly compare data regarding your business figures against industry averages. If any of the comparisons reveal a sharp change from one period to another or significant deviation for the industry average, the tax authorities are likely to request supporting documents to assist in their assessment of your business and tax liability.Fapiao comparisons

The tax authorities are monitoring not only the value of fapiaos issued but also the number of pieces. VAT fapiaos are closely controlled with only a limited number of pieces given by default to each business. An increase of over 30% between periods is very likely to result in an inquiry from the tax authorities asking for an explanation for the increase.Sales comparisons

A sharp decrease in sales from one period to another is likely to result in the tax authorities requesting supporting material. If a business loses a key account or reallocates its revenue to a different legal entity within a different jurisdiction, it should ensure that it has the required supporting materials to satisfy the tax authorities with their inquiry.Cost/sales ratio comparison

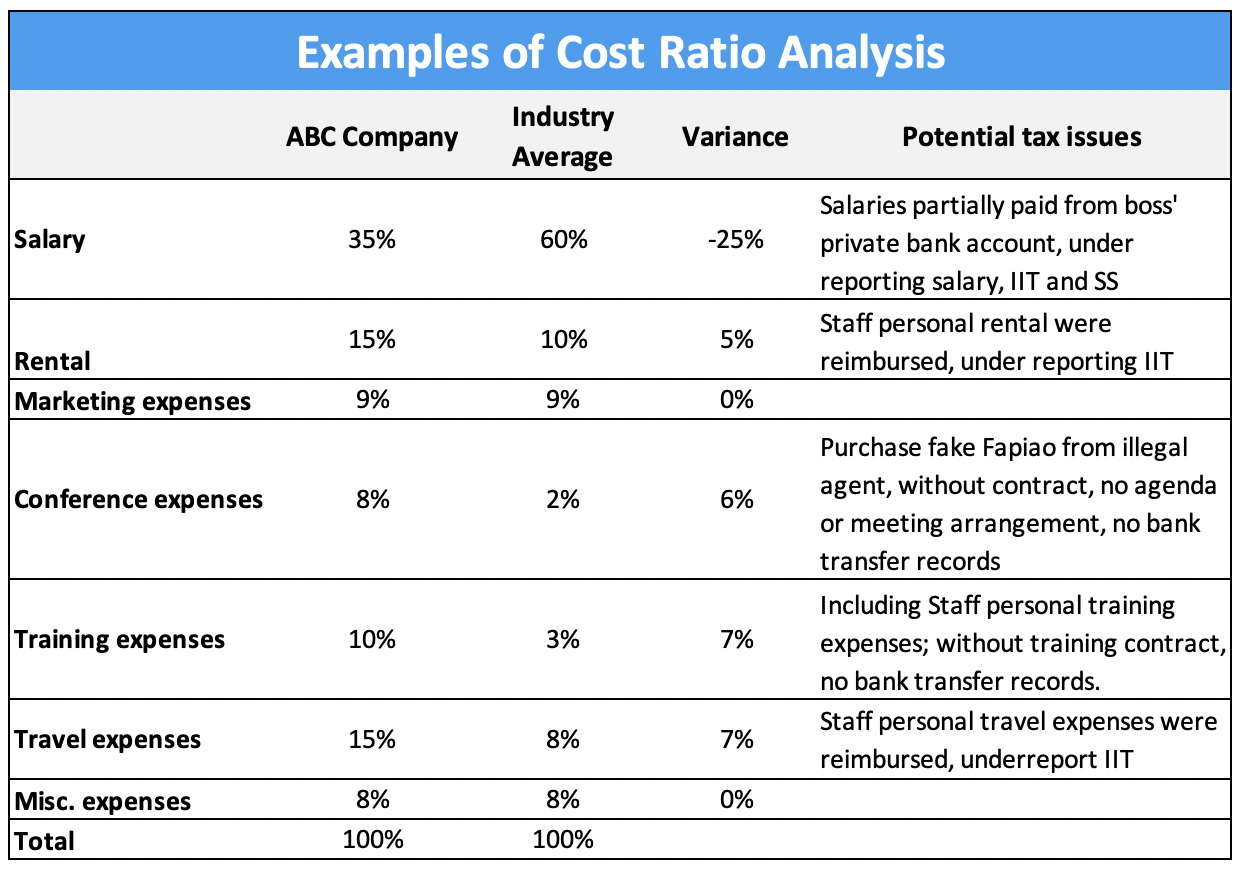

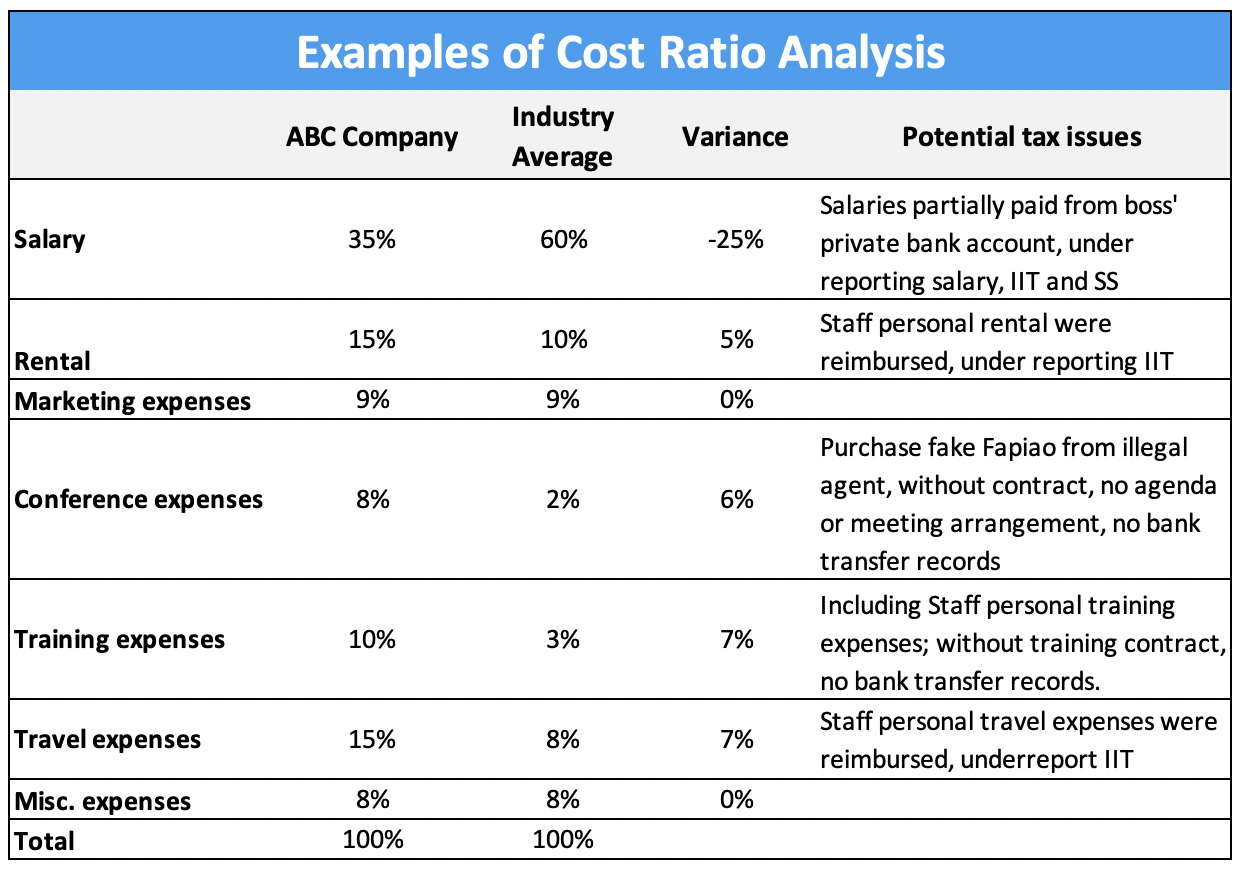

There are many ways for business’ to overestimating their expenses allowing them to manipulate their profits for a specific period. The ratio between a certain type of costs incurred by a business vs its sales within a period is being monitored closely by the tax authorities and compared against industry averages. More severe misrepresentation of expenses is the use of fake or irrelevant fapiaos to offset revenue, therefore, reducing CIT payments. In these cases, the cost/sales ratio comparison will be consistently higher than the average and likely require the business to provide evidence to support its financial reporting.

More severe misrepresentation of expenses is the use of fake or irrelevant fapiaos to offset revenue, therefore, reducing CIT payments. In these cases, the cost/sales ratio comparison will be consistently higher than the average and likely require the business to provide evidence to support its financial reporting.

Profit comparison

A business’ profits are being monitored against its past performance and against the industry averages. Variations between periods are unlikely to result in attention from the tax authorities by this alone. However, consistently reporting lower margins or losses compared to the industry averages is likely going to result in a tax audit.Tax payment ratio comparison (税负率)

In principle, the tax burden, including VAT, CIT, IIT and other taxes paid, of a business as a percentage of sales should be relatively consistent between periods and with their industry. Tax payments as a percentage of sales which are continuously lower than the industry average are very likely to attract the attention of the tax authorities.Ratio Analysis

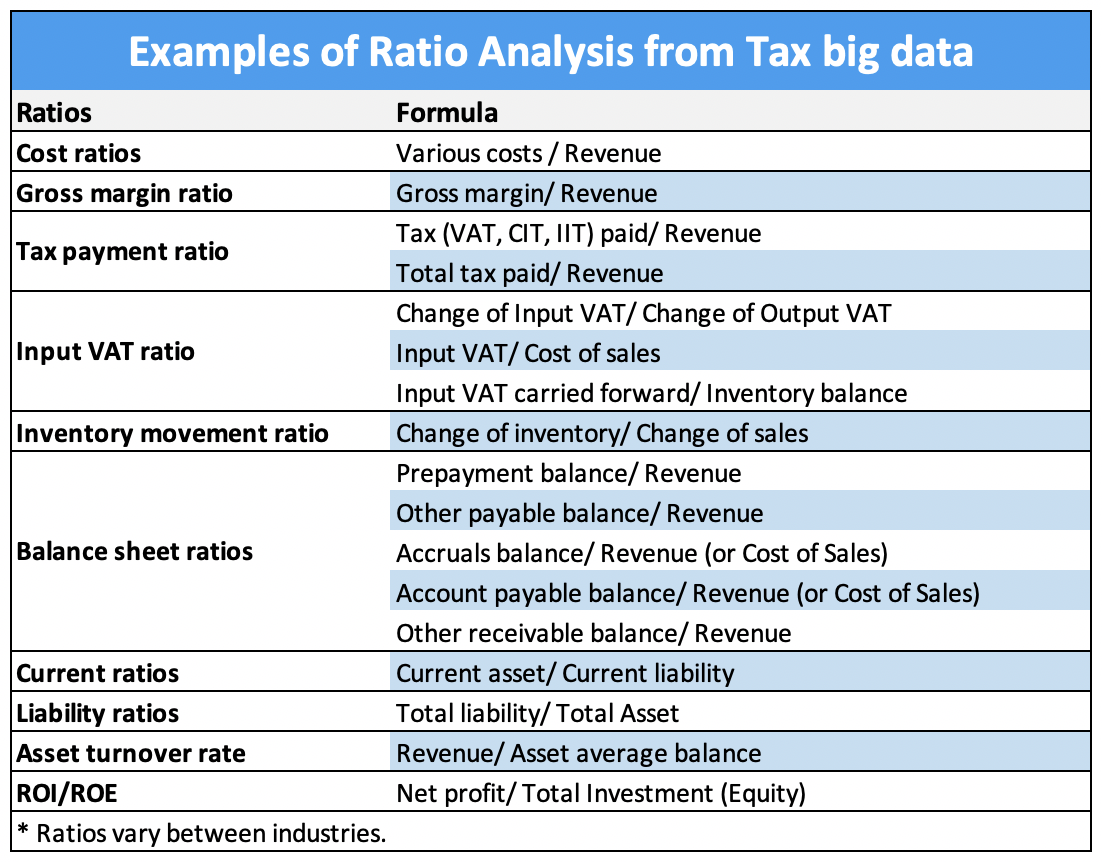

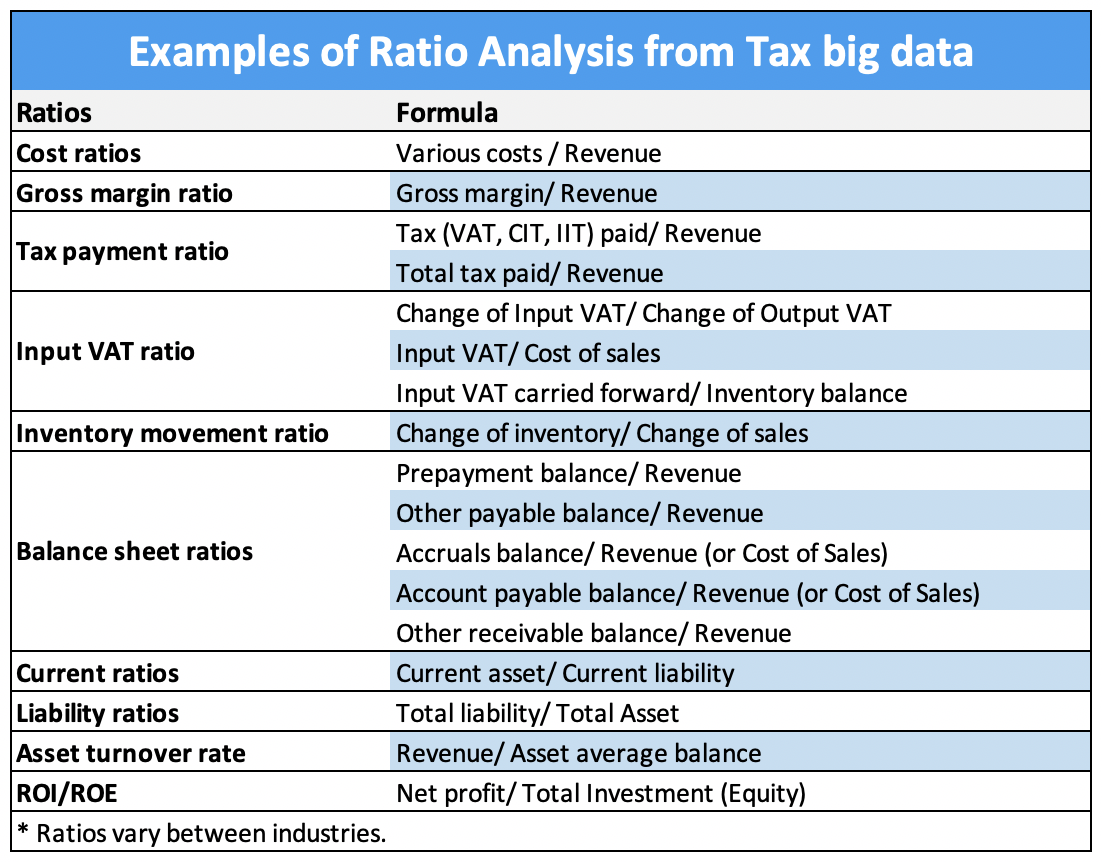

During monthly, quarterly or annual reporting there are several important ratios which provide a good indication for the tax authorities of whether your business is reporting its financial data completely and accurately.

Input VAT vs. output VAT

How much input VAT you deduct versus your output VAT can be correlated with other businesses in your industry. A service company should have little input VAT, hence they pay a lower tax rate of 6%, versus manufacturing and trading companies who can deduct the input VAT paid on their material purchases. Thus, an increase in input VAT should be consistent with the increase in output VAT.Input VAT vs. cost of sales

The ratio of input VAT vs the cost of sales should between 0 – 16%. If the ratio is higher than 16% there must be something wrong.Unused input VAT vs. inventory closing balance

The amount of unused input VAT carried forward should be directly linked to the inventory closing balance.Change in Inventory vs. Change of sales revenue (存货变动弹性系数)

If the inventory balances keep increasing without a corresponding increase in sales revenue, this is likely to attract the attention of the tax authorities. They will ask for a detailed inventory movement table or in more severe circumstance, request to visit your warehouse to inspect physical goods.Balance sheet items

The balance sheet is an important financial report containing details about the transactions a business has made in current and previous years. An experienced auditor will be able to look at a company’s balance sheet and immediately identify where they might find evidence of improper bookkeeping or manipulated profits and tax liability. The key balance sheet items that tax authority focus are: Inventory, Other Receivable, Accruals, Account Payable, Prepayment, Other Payable. These items help the tax officer easily find out if the company hide the revenue or overstate expenses.Verifications

Verification is becoming a more common tool to crack down on fraudulent behavior in China. The aim is to introduce the necessary accountability and accuracy to the data being collected through the big data tax plan. Under the big data, tax authority can verify the information from other government departments, banks or companies, including Commercial and Administration authorities, Customs authorities, Social security authorities, SAFE (State Administration of Foreign Exchange), bank (Company & individuals accounts), etc.