Foreign business owners or management team always take financial transparency as a pre-condition for good decision making and sustainable profitability. However, achieving the visualization of business operation becomes a luxury for most of foreign SME business operating in China, owing to the following 2 reasons:

- Hard to find a qualified accountant with reasonable salary

- Hard to retain a qualified accountant when your business is small

The problems are even worse for trading and manufacturing companies with operations located far away from downtown area of central cities such as Shanghai.

Some of you may not be habituated to the outsourced accounting service solution as you prefer an in-house accountant sitting in your office and responding to your questions and issues anytime. The rest may have tried the outsourcing solution but are not satisfied with the work deliverables of service provider as they only handle the tax filings, but are either not willing to or not capable of penetrating into your business to produce financial data meeting the standard of business analysis and decision making.

Cloud technology empowers outsourced accountants to bring the value of their service to the next level. Accountants, armed with the digital technology, can work seamlessly in collaboration with their clients in one unified online platform and get deeply involved in their daily operations, while still staying remotely from clients’ office.

Sounds interesting and exciting, right? But how it works?

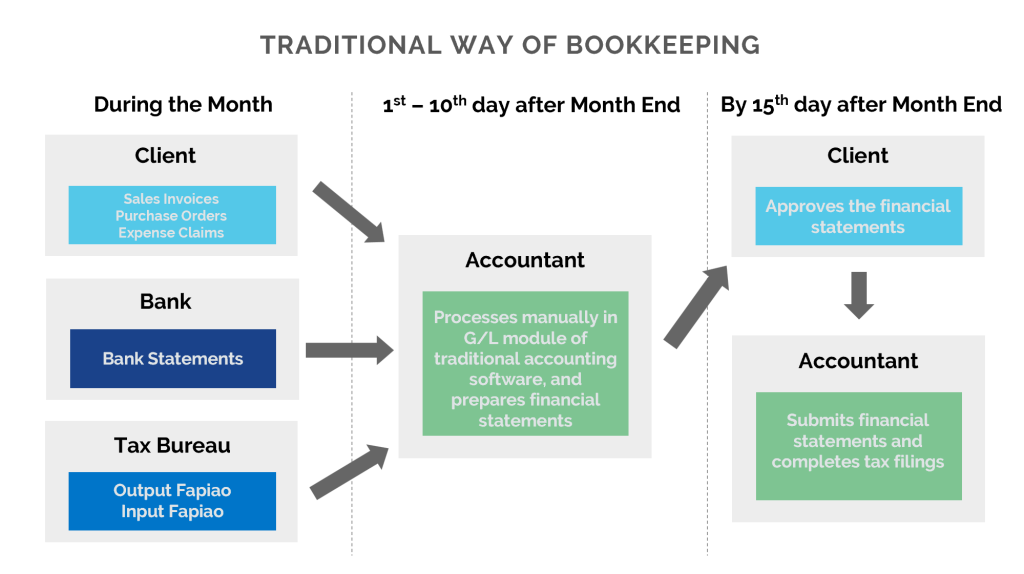

Let’s take a look at how the traditional way of bookkeeping works first (see the below diagram).

The conventional accountants collect paper or digital copy of documents (i.e. fapiao, bank statements) at the end of each month, and perform the bookkeeping in the beginning of the next month in the General Ledger module of an on-premise software, and then complete the tax filings before the due date. In this way, the owners or management team are cut off the access to real-time accounting data, and therefore they hardly feel the presence of the “accounting services” in substantially supporting their business.

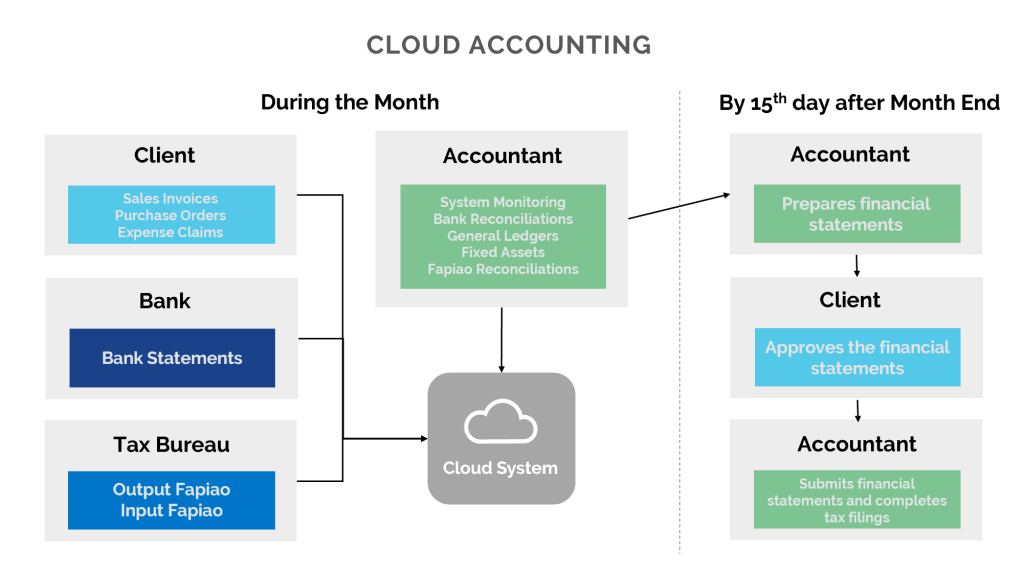

Cloud accounting platform is a game changer to this situation (see the below diagram).

The accountant and the operation team are brought into close collaboration in using one online system, and business and financial data are processed and exchanged on the real-time basis. Accountants, not necessarily sitting in client’s office, can monitor the transaction data in the cloud system and provide feedback to users in a timely manner. The roles and responsibilities of an accountant are switched to:

- Streamline the internal business process to improve operation efficiency and internal control, and implement the workflow into the cloud system;

- Help with structuring the business and financial data, which allows reporting to be generated in support of financial analysis and management decision making;

- Monitor the system to ensure the timeliness, completeness and accuracy of the business data;

- Check the correctness of the accounting entries generated from the business data;

- Make general ledger adjustments and produce management accounts (not statutory financial statements);

- Complete the tax filings; and

- Help interpret and explain prepared financial data and provide business advisory.

In this way, the online system remains synchronized with latest and accurate transaction data. Owners and management team can check the system to get the information they want rather than asking accountants to prepare the worksheets manually. Accountants can be extensively involved in client’s business operation for timely detection of any significant deviations occurring in business operation.

Case Study

We have a German client which is a leading manufacturer of automated parking systems and storage systems for sheet material and long-span goods in Europe. The client has a manufacturing WFOE in the suburb area of Changzhou, Jiangsu Province (about 180km away from Shanghai) to assemble the parking and storage systems and sell to the local market. The manufacturing process is a little complicated as the assembling involves 6 – 7 layers of Bill of Materials (BOM) with 1000 – 2000 components and parts. Considering the complexity of the manufacturing process, the client needs an ERP system to support its operation, as well as professional accountant to ensure the execution of operations is under control and financial statements are correct for decision making. They attempted to employ a qualified accountant from local area, and concluded it almost impossible to find any candidate with adequate competency in both skills and experiences. Eventually they turned to us for cloud-based accounting outsourcing solution.

Our methodology consists of the following 3 stages:

Stage 1: Choosing the cloud-based system

After conducting an in-depth investigation of the client’s business and the production management requirements, we agreed with the client to introduce Jeenie cloud ERP application (www.jeenie.com.cn). Jeenie has integrated accounting, inventory and production management modules, which sufficiently supports the management of BOM, and precise collection and calculation of production costs.

Stage 2: Acting as the client’s accountant during the system implementation

We act as the client’s accountant and coordinate with software consultant of Jeenie to carry out system implementation. The below table shows the milestones of the implementation and our role in each milestone.

| No. | Milestone | Project Activity | Client’s Role | Accountant’s Role |

|---|---|---|---|---|

| 1 | Business Requirement Study | Jeenie consultant conducts the requirement study to understand the client’s sales, purchase, warehouse, production management, as well as accounting process and requirements | Describe and explain functional processes in response to implementation consultant, as well as raise business requirements. | Advise the accounting treatment of each business transaction of sales, purchase, warehouse, and production; Supply expertise for improved internal control and financial reporting |

| 2 | Master Data Preparation | Jeenie consultant provides guidelines and templates on how to prepare master data | Prepare master data including inventory/service items, suppliers, customers, employees, BOM etc. | Prepare Chart of Accounts, accounting dimensions etc. Make sure that business and accounting master data are coherent |

| 3 | Blueprinting | Jeenie consultant drafts business blueprinting documentation to address business process and requirements of the client | N/A | Check the blueprinting to ensure that business process, controlling and reporting requirements are adequately and properly addressed. |

| 4 | Prototyping | Jeenie consultant demonstrates business procedures and functions in the system according to the project blueprinting | Review, discuss and approves the business blueprinting | Supply expertise in assisting client’s management to review, discuss and approve the accounting blueprinting |

| 5 | System go-live | Jeenie consultant creates the organization database in cloud system, import master data and opening balance, providing functional training to the users | Prepare opening balance data, and attend system training | Assist client in preparing opening balance. |

Stage 3: On-going system monitoring and accounting work

In the first 3 – 6 months after system goes live, we closely monitor the transactions input by the client into the system, to make sure all the business data are correct and the workflow rules documented in the blueprint is strictly followed. By doing so, the personnel of the client incrementally got used to the system in the correct way. We see to it that the financial data generated from the business transactions in the system are accurate. Jeenie cloud ERP system serves as the platform on which we communicate with the client about the day-to-day operation, and thus visiting client’s office to acquire business documents and perform bookkeeping is rendered as no longer necessary.

Our client is very satisfied with the outsourced accounting solution supported by cloud technology, as they achieved financial visualization at a cost lower than hiring an in-house accountant with the same level of accounting expertise.