Asked what is the most troublesome and confusing thing when doing business in China, 1 out of 3 expatriate business managers would say fapiao handling and the problems it poses for their internal control procedures.

Mishandling of fapiao can cause tax overpayment and apparently loss of your money. Therefore, identifying the issues and risks regarding to handling fapiao and having the right procedures in place in dealing with fapiao is a crucial element of business controlling in china.

In this short article, we are going to look at:

– Brief introduction about fapiao

– What are the risks hidden in fapiao handling process

– How to properly address those hidden risks

What is fapiao?

Simply speaking, fapiao is a mechanism brought into place by Chinese government to capture business transactions in the economy to ensure tax collection. It is materialized in a form of paper receipt as a proof of business transactions. There used to be many types of fapiaos for different industries or different types of business transactions.

Before 1 May 2016, China’s turnover tax system was comprised of value added tax (“VAT”), business tax (“BT”) and consumption tax (“CT”). After rounds of tax reforms starting in 2012,where business tax (BT) is unified into the value added tax (VAT) system, VAT becomes the most important tax category in the turnover tax system. Consequentially VAT fapiao which is used for VAT collection becomes the dominant fapiao form.

VAT Fapiao can be sorted into two categories:

- Special VAT fapiao – used as input VAT vouchers for input VAT deduction, issued by a general VAT taxpayer to another business;

- General VAT fapiao – used for all other instances as a proof of business transaction and can not be used for tax deduction.

For VAT payable calculation, it is computed by using a formula, when your business is entitled to VAT tax deduction, as:

VAT payable = Current output VAT – Current input VAT

Output VAT = Sales volume * VAT rate

Input VAT = purchase amount * VAT rate

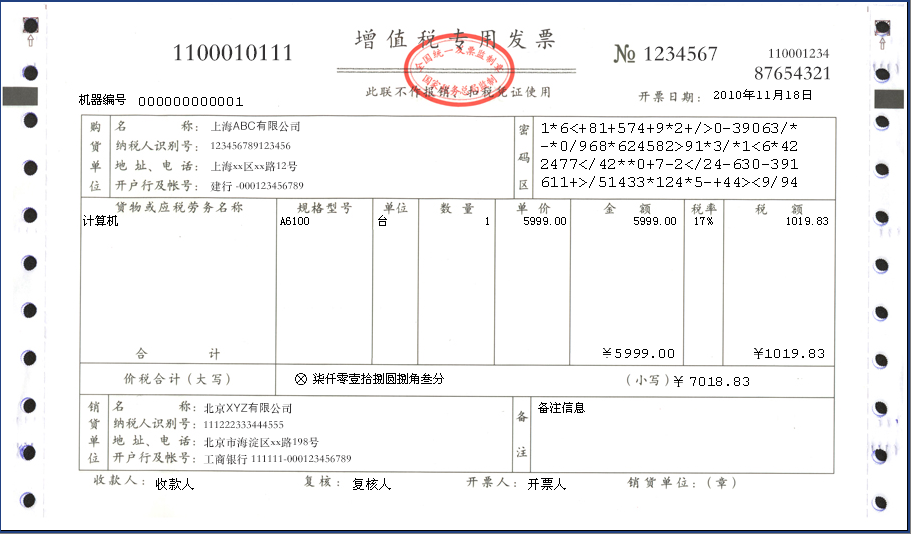

A typical special-VAT fapiao (see sample above) carries information such as the name and the unique tax ID of issuer (sales side) and recipient (purchase side), list of commodity items, transaction amount, tax rate and the VAT amount etc.

The following is an exposition about risks related to fapiao handling and practical solutions.

For more about Fapiao’s, take a look at What You Need to Know About Chinas VAT Fapiao’s (Part 1).

Risks of business transactions not matched with fapiaos

Input fapiao

– No input fapiao received for a purchase made.

Reasons of this occurrence can be supplier’s accountant is not informed about the transaction, the supplier intentionally delays fapiao issuing, your staff forgets to ask for fapiao when a purchase happens and others.

This is a huge problem because the loss of input fapiao reduces the amount of input VAT for tax deduction.

– Incorrect amount on fapiao.

This can arise from supplier’s manual mistake of issuing fapiao with incorrect amount, especially when the fapiao amount is lower than the transaction amount, resulting in a loss of input VAT as a credit for tax deduction.

In a worse case, it coud even be possible that your supplier issues you fapiao for which there was no actual purchase transaction or issues you two times of fapiao for the same purchase transaction. In such circumstanes, sure you don’t want to pay your supplier for business that does not exist.

Output fapiao

– Duplicate fapiao for same sales.

Your customers may request for the fapiao for same sales twice, usually when they lose the first one. Duplicate issuing fapiao will double your output VAT payments for such transactions.

– Undetected sales receivables with fapiao issued.

Certain customers may have a policy of making payments only after fapiaos are received. It should be noted that you are liable for the VAT when a fapiao is sent to your client regardless of the revenue is received or not. Therefore, this becomes an issue especially when fapiao is already sent to your customer without sales revenue received. Your financial loss will not only be the loss of revenue but also the VAT liability.

How to address it?

We will ensure all your business transactions and fapiaos are recorded and traced by using MEGI as online accounting platform. In China, every fapiao issued is real-time updated on government’s system. A remarkable function of MEGI feeds those real-time data from tax bureau into your MEGI account only by few clicks.

We can match and link fapiaos to related business transactions with 100% completeness and accuracy in an effective manner. Therefore we help to ensure all fapiaos are precisely traced back to its corresponding business transactions and prevent these risks from being turned into real losses.

Issues of fapiao handling when an outsourced accountant is engaged

When you hire accountants externally, fapiao will flow through the hands of supplier, purchaser, and external accountants for matching with transactions, verification and tax deduction. Having more parties involved in the transferring process tremendously increase the risk of fapiao mishandling, especially if a rigorous controlling procedure is not in place.

For example, fapiao missing in the process of handover becomes a very likely occurrence. Also, external accountants usually work for multiple business clients. Fapiao of different companies might be mixed up and each company’s fapiao may not be used correspondingly for tax filing.

Those issues will cause incorrect tax filing and overpayment of tax.

How to address it?

Through using fapiao status tracking function of MEGI, we can monitor and control every step involved in fapiao handover process. Issues mentioned above can be well managed and controlled. For example, missing fapiao can be totally avoided by monitoring and tracing physical fapiao received.

Input fapiao verification date overdue

Verification of fapiao’s authenticity must be completed before an input fapiao becomes a validate proof for tax deduction. Time limit for this is within 360 days from fapiao issue date. Verification overdue will give rise to fapiao invalidation for tax deduction and therefore loss of your money.

How to address it?

We can also address this risk by making use of functions relevant to fapiao verification in Megi cloud accounting. We can see fapiao issue date and its relevant status clearly on the platform. Any fapiao which is getting close to its verification due date is appealing to eyes; therefore verification overdue can be completely prevented.